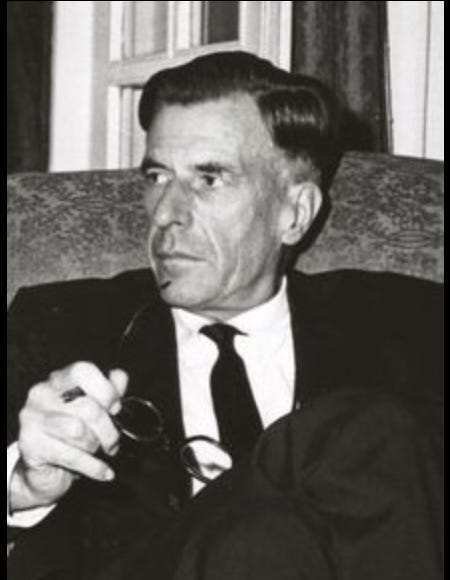

Back in the long-ago days of 1997, well before cryptocurrency had become A Thing, John Kenneth Galbraith described his fascination with such financial bubbles:

I have been fascinated all of my academic life by the phenomenon of the great speculative boom (and its aftermath), going back to the Tulipomania in Holland in 1637. It was [Arthur] Schlesinger [Jr.] who, by example, urged upon me not only the modern relevance of this experience but more particularly the need again to see the common threads in human motivation. These, when looked for, appeared and reappeared with a wonderful consistency. Whether of tulip bulbs, of John Law's Louisiana promotions, of the stock of the South Seas Company or of RCA, the great speculative favorite in the stock market boom of the late 1920s, or of the deeply redundant real estate developments in the 1980s, prices were going up.

The mentally vulnerable, of whom there is always a more than adequate reserve, were attracted and responded. Their response caused prices to go up more; this price rise then confirmed them in their superior wisdom and foresight. They and others bought more; prices went up more; the process now had a life of its own, which continued until the current stockpile of financial and mental decrepits was exhausted. Then prices faltered, and there came the rush to get out, the crash. One reliable aspect of such an event is the enthusiasm that will have led some of the participants beyond the law. The drama, if such it may be called, almost always ends in public indignation, the courts, suicide, or assignment to relatively comfortable places of detention.1 [my emphasis; paragraph break added]

For a very quick look at some famous bubbles, see Deborah Petersen’s short piece (also pre-crypto-bubble) on Tulip Mania, the Mississippi Bubble, the South Sea Bubble, the Latin American Debt Crisis, and the Great Depression.2

For the scammy nature of the crypocurrency hype, see this excellent 2021 piece by Nathan Robinson, “Why Cryptocurrency Is A Giant Fraud.”3

Galbraith, John Kenneth (1997): The Lessons of An Historian. In: Diggins, John Patrick: The Liberal Persuasion: Arthur Schlesinger, Jr., and the Challenge of the American Past, 62. Princeton: Princeton University Press.

Petersen, Deborah (2014): A Brief History of Financial Bubbles. Stanford Business School 11/24/2014. <https://www.gsb.stanford.edu/insights/brief-history-financial-bubbles> (Accessed: 18-08-2023).

Robinson, Nathan (2021): Why Cryptocurrency Is A Giant Fraud. Current Affairs 04/20/2021. <https://www.currentaffairs.org/2021/04/why-cryptocurrency-is-a-giant-fraud> (Accessed: 2023-18-08).

An excellent historical reminder.